El Salvador to Abandon Bitcoin as Legal Tender in Exchange for a $1.3 Billion IMF Loan

El Salvador, the Central American island nation, became the first country in the world to adopt Bitcoin as legal tender, allowing it to be used for any transaction within its borders, such as everyday purchases or payments between businesses.

However, due to Bitcoin's significant volatility, high transaction fees, and slow transfer speeds, most residents and businesses in El Salvador have been reluctant to use Bitcoin in practice.

El Salvador also recognizes the US dollar as legal tender, which is used far more frequently in daily life than Bitcoin, rendering the country's plans for a Bitcoin City unfulfilled.

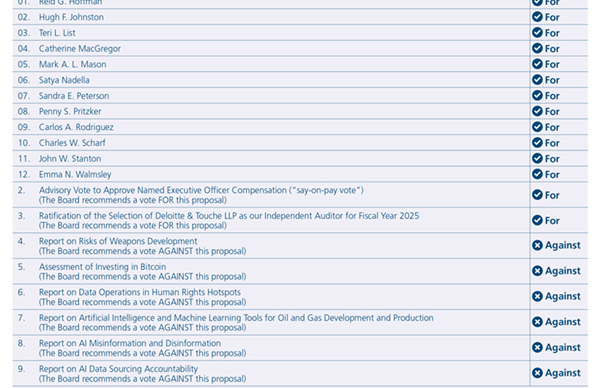

The move to designate Bitcoin as legal tender initially drew criticism from the International Monetary Fund (IMF), which found the decision somewhat amusing. The IMF argued that using Bitcoin as legal tender posed risks to financial stability and integrity.

The issue lies in the IMF's role in providing assistance loans to various countries, and El Salvador's stance made the IMF reluctant to offer loan support. However, El Salvador is indeed in dire need of substantial funds for infrastructure investment.

According to a report by the Financial Times, El Salvador has eventually compromised with the IMF and is expected to reach a $1.3 billion loan agreement within the next 2-3 weeks. As part of the agreement, El Salvador must abandon its practice of using Bitcoin as legal tender and reduce its government deficit.

Furthermore, El Salvador will need to revoke the legal requirement for businesses to accept Bitcoin payments, shifting to a voluntary basis where businesses can choose to accept Bitcoin or use the US dollar instead.

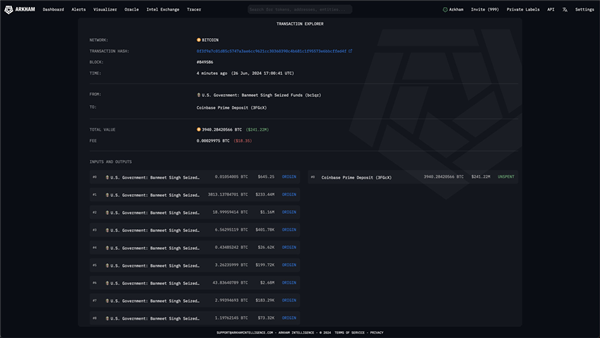

Currently, El Salvador is striving to revive its economy and seeking support from foreign investors, having indeed realized significant unrealized gains from its accumulation of Bitcoin at low prices.