Saving Intel: U.S. Government Considers Unprecedented Support for Tech Giant

Recently, the tech community was abuzz with rumors that Qualcomm might acquire Intel, a move that appeared surprising given Intel's massive scale and its recent challenges. Despite Intel's struggles, the notion of Qualcomm, another titan in the tech industry, acquiring it seemed far-fetched.

However, this acquisition scenario is not as improbable as it first appeared. In the United States, Intel is considered "too big to fail," and policymakers are contemplating providing aid to ensure its survival. This assistance wouldn't be immediate but is being discussed as a contingency plan should Intel fail to recover on its own. The support could include financial aid, policy backing, and even facilitating mergers with other industry giants like AMD and Marvell.

Drawing lessons from the 2008 bailouts of Chrysler and General Motors, U.S. legislators are considering encouraging mergers as a way for Intel to self-rescue rather than offering a one-off bailout. However, some experts believe that splitting Intel might not be beneficial.

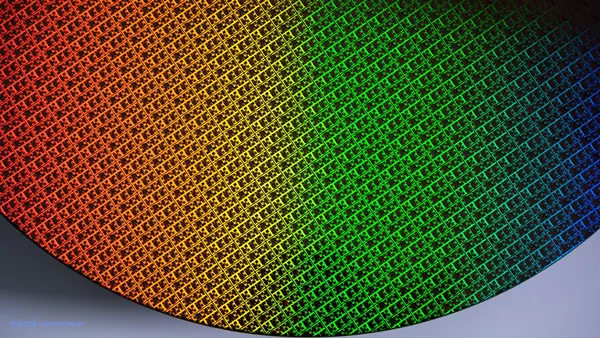

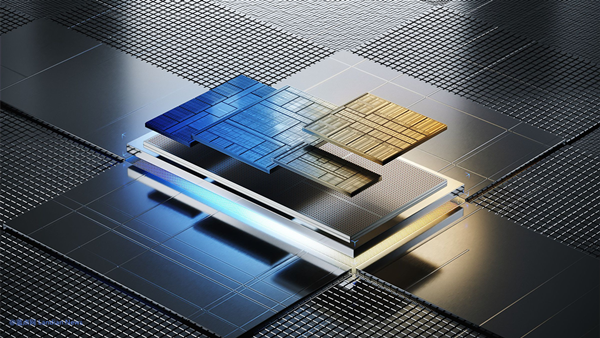

Why is it crucial for Intel to remain afloat? Intel stands as the only U.S. company that both designs and manufactures chips, a critical asset for the United States to maintain competitiveness in the global semiconductor industry. Other American companies, including Nvidia, AMD, Qualcomm, and Marvell, rely on foundries like TSMC or Samsung for chip manufacturing, lacking Intel's in-house production capabilities.

The collapse of Intel would not only jeopardize its manufacturing facilities but could also force the U.S. to depend on overseas foundries, an unacceptable scenario for national security and technological independence. Although Samsung and TSMC have initiated manufacturing operations in the U.S., these are minimal compared to their global production, insufficient to meet the country's needs.

Moreover, Intel's significant role in the U.S. economy cannot be overlooked. In 2023 alone, Intel exported semiconductors worth $40 billion, making it one of the country's largest exporters. From an economic standpoint, U.S. policymakers have a vested interest in ensuring Intel's continued operation and success.