Analyst reveals reasons why Intel adopts and abandons packaged memory: Is it just a rash move to single out Qualcomm?

Intel's recent announcement to discontinue incorporating memory directly into its processor chips, reverting to the traditional CPU+RAM separate design, has sparked considerable interest. Esteemed analyst Ming-Chi Kuo from TF International Securities reveals that this move, which had been anticipated by the industry for at least a year, was driven by specific strategic considerations and challenges.

Intel's foray into integrated memory within CPUs was primarily motivated by two factors:

- Competition with Apple's M Series Processors: The market share gains by Apple after the adoption of its M series processors for the MacBook line prompted Intel to demonstrate that its x86 architecture could also achieve comparable energy efficiency and battery life through memory integration.

- Response to Microsoft Surface's Adoption of Qualcomm Chips: Microsoft's Q2 2024 new Surface devices, all equipped with Qualcomm chips boasting 45TOPS of computational power, pushed Intel to develop a competitive product.

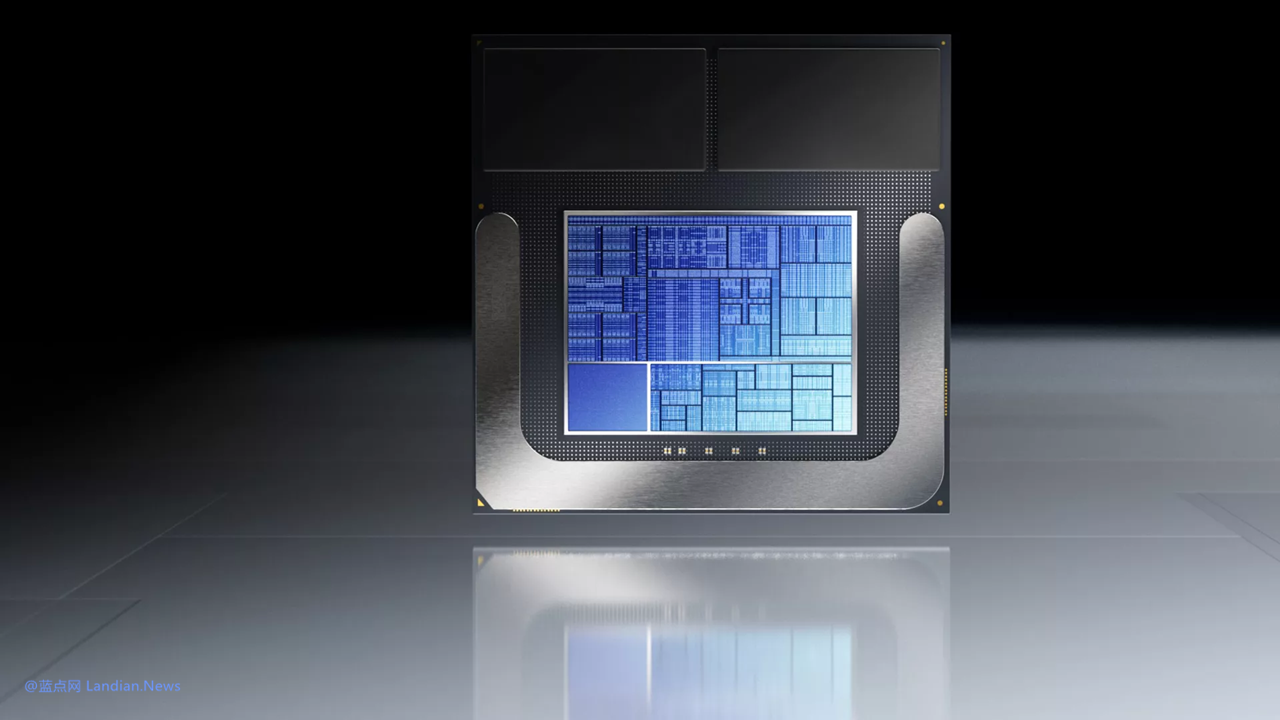

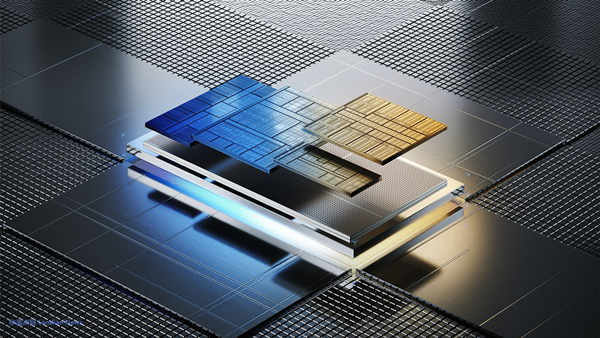

To meet these challenges, Intel's Lunar Lake processors included integrated DRAM, designated specific components, and boosted the NPU (Neural Processing Unit) computational power to 48TOPS.

Notably, only the Lunar Lake processors, set to launch between 2024 and 2025, met Microsoft's Copilot+PC certification standards, which require at least 40TOPS of computational power.

The decision to step back from integrating memory within CPUs boils down to costs and profit margins:

- Cost and Profit Concerns for Brands and Manufacturers: The adoption of the Lunar Lake processors was hindered by the decreased flexibility in parts selection, which negatively impacted the profit margins of brands and manufacturing partners. For OEMs, memory components are a crucial factor in reducing costs and enhancing profits.

- High Costs for Intel: The cost implications for Intel were significant, including weaker bargaining power with DRAM suppliers compared to Apple and reliance on TSMC for manufacturing, which kept costs high.

- Market Reception of Microsoft Copilot+PC: The Microsoft Copilot+PC, at least for now, remains an immature product. Consequently, consumers are hesitant to invest in higher-priced Lunar Lake processors.

Kuo suggests that the Lunar Lake processor's failure underscores not only Intel's challenges in catching up with manufacturing processes but also deeper issues in product planning and organizational decision-making. The core issue for Intel may lie in its organizational mechanisms, which have led to a series of misguided product decisions.