The latest rumors suggest that Qualcomm has paused its plans to acquire Intel, deciding to wait until after the US presidential election in November.

Market rumors had previously circulated that chipmaker Qualcomm was considering acquiring Intel's design department and other teams. Intel's design department is mainly responsible for the development of desktop processors, and Qualcomm's aim might be to enter the desktop market through the x86 architecture.

There are also speculations that Qualcomm might acquire most of Intel's business, potentially leading to a merger that would make the new company the largest semiconductor company in the world by market share.

However, there are many challenges ahead, with the most critical being how Qualcomm can convince regulatory bodies to approve the acquisition or merger. For major market regulators, a Qualcomm-Intel merger is definitely not good news.

Qualcomm currently holds a significant market share in the smartphone market, while Intel dominates in the PC, server, and data center sectors. Clearly, a merger between these two companies would bring monopoly pressures to the market.

Nevertheless, Qualcomm has its considerations and would not have overlooked such an obvious antitrust issue. Thus, Bloomberg has released new information stating that Qualcomm has put the acquisition plans on hold, waiting for the outcome of the US presidential election in November.

The reason for pausing the acquisition stems from Qualcomm's desire to understand the new US government's antitrust policies and attitudes post-November. If former President Donald Trump were to be re-elected, it could be good news for Qualcomm, given Trump's relatively lenient stance on antitrust issues concerning large American companies.

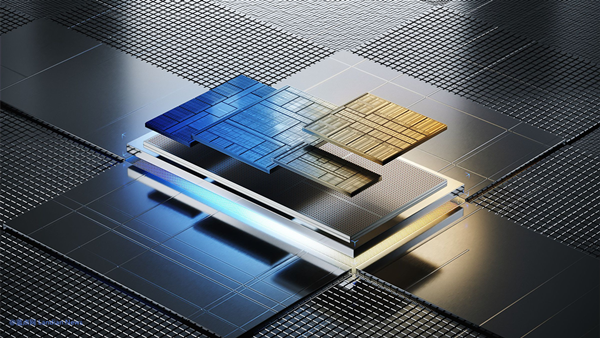

On the other hand, the Biden administration has actively pushed for chip production in the US to meet the country's self-sufficiency goals in the chip sector, with Intel playing a crucial role in this plan. Considering the financial support for the chip sector from the US government post-November is also a factor for Qualcomm.

The attitude of the new US government towards antitrust issues and its policy on financial support for the chip sector are crucial. Qualcomm is now waiting for the dust to settle on the election before considering its next move. Having decided to acquire Intel or part of its business, Qualcomm is unlikely to give up easily.

Another consideration for advancing the acquisition is the price factor. Intel will announce its new financial report at the end of October. If the report is still very poor, Qualcomm could continue to press for a lower price; if the new US government's stance on antitrust is not strong, Qualcomm could also use this to negotiate a lower offer.