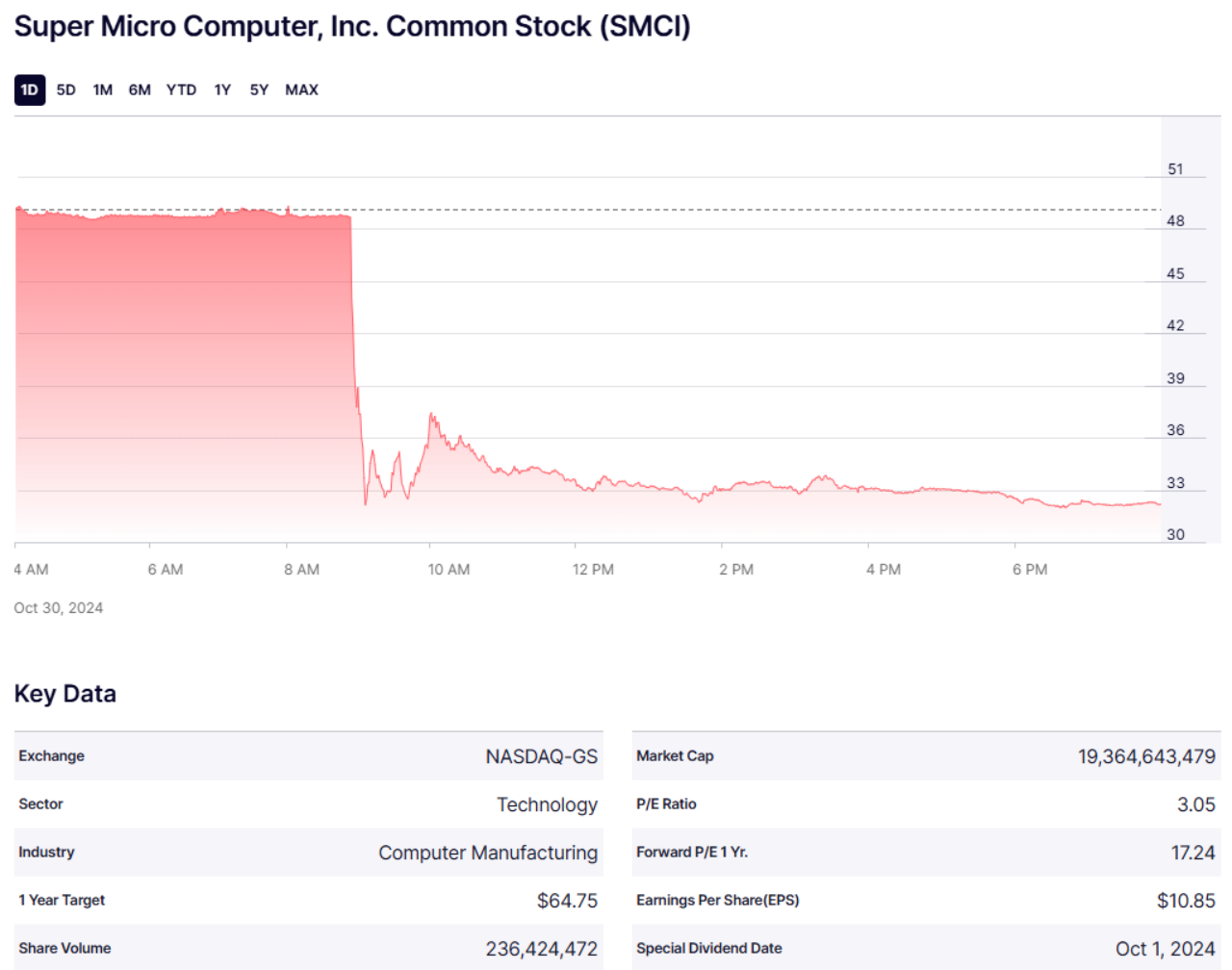

The auditor of the popular AI stock Super Micro Computer (SMCI) resigned, and the stock price plummeted 33% in an instant

Riding the wave of AI enthusiasm, Super Micro Computer (SMCI), a once-celebrated chip stock, saw its share price soar from 27 122 since the start of 2024, completing this remarkable ascent in just two months. Super Micro, known for its development and production of servers, particularly AI servers, has received numerous orders, positioning it alongside hot AI companies like Nvidia and AMD.

However, the upward trajectory was halted following the release of a short seller report, which after investigation, alleged that SMCI engaged in transaction and financial statement fraud by inflating order volumes and revenue through inter-company transactions.

The situation escalated yesterday evening when SMCI disclosed in a report that its auditing firm, Ernst & Young (EY), had tendered its resignation. This indicates EY's lack of trust in the financial data provided by SMCI or the discovery of false financial data. Typically, the resignation of an auditing firm is a serious issue for a publicly traded company, leading to SMCI's stock price plunging over 33% overnight, dragging down other chip stocks, including Nvidia and AMD.

EY revealed its resignation was due to concerns over the company's governance and transparency, questioning the company's commitment to integrity and ethics. Despite this, Super Micro remains defiant, disagreeing with EY's decision and stating it does not believe any issues raised would necessitate the restatement of its financials for fiscal year 2024 or prior.

However, the U.S. Department of Justice has been investigating Super Micro since September, and regulatory bodies are expected to clarify the situation soon. If financial fraud is confirmed, Super Micro could face severe penalties.